Lebanon’s Deposits Crisis: Who’s to Blame? Us or Them?

Let’s travel backward to February 2019. A typical Lebanese citizen, whether living in Lebanon or abroad, was encouraged to deposit his or her lifetime savings at a Lebanese bank, regardless of whether it was 5 thousand USD or 5 million USD. This became a mass phenomenon with the increase of interest rates to about 7.5% on USD deposits and 10% on LBP deposits. I still remember discussions between people and how they used to brag when they earned a 0.25% rate higher than their friends or family members on deposits of similar terms. A common story among friends was their fireside chats with their partners when they had opposing opinions on whether their common savings deposits should be at Lebanese banks or invested elsewhere. After all, would any sensible person want to lose the chance to generate easy returns? Others felt it was too good to be true. Unfortunately, that turned out to be the case.

Fast forward 8 months to October 2019 and Lebanon is in chaos as demonstrators take to the streets and banks are forced to close their doors temporarily. Days later, banks reopened to a new reality. Informal capital controls were put in place which prevented people from withdrawing their savings or transferring them abroad. The dollar exchange rate increased considerably from 1507.5 LBP for 1 USD to 2000-2500 LBP for 1 USD. Understandably, people started questioning whether they would ever be able to recover their money from Lebanese banks.

What does this tell us about ourselves? Are we bad investors who risked it all and placed our investments in the wrong place? Are we the only ones who did this? Were we tricked and fooled by the banking system and government who used our money carelessly and irresponsibly? Who’s to blame? Is it us or them?

My proposed theory, based on my personal point of view, is that it is definitely them and not us. Do you have doubts? Read on.

1. The bank manager

For decades, the Lebanese banking industry was praised as being the best, if not the only, sector supporting the economy. Professionals in the banking industry in their Ferragamo ties and LV belts, were a symbol of financial literacy, trust and confidence, at least to the general public.

Before the crash of October 2019, bank managers worked tirelessly to attract deposits and fresh funds to their branches. When they were asked by clients about the stability of the LBP, their answer was fast and confident: “the Lebanese Lira has been stable for the past 25 years. If anything was going to happen, it would have already happened”. They added, “Do not worry. Your deposits are fully safe and they are held within the best hands”.

Having mentioned the shiny status of bankers, it is therefore perfectly rational for an average Lebanese person to accept, if not blindly, any branch manager’s recommendation. But the question is, did those managers provide optimal recommendations to their clients based on fundamental analysis and financial basics? Or were they just whispering into the ears of the less financially knowledgeable empty promises that would keep deposits coming through the doors of their branches? Looking at the current reality and how bankers reacted to the crash, I would say that at best, what they did was negligence and at worst, it was intentional deceit.

Now let us look at their bosses. The investment committees and board of directors.

2. Investment committees and board of directors

J. Wolfensohn, president of the World bank, as quoted in the Financial Times on June 21, 1999, said that "Corporate governance is about promoting corporate fairness, transparency and accountability”. Undoubtedly, the board of directors is the central pillar in maintaining and promoting a corporation’s governance.

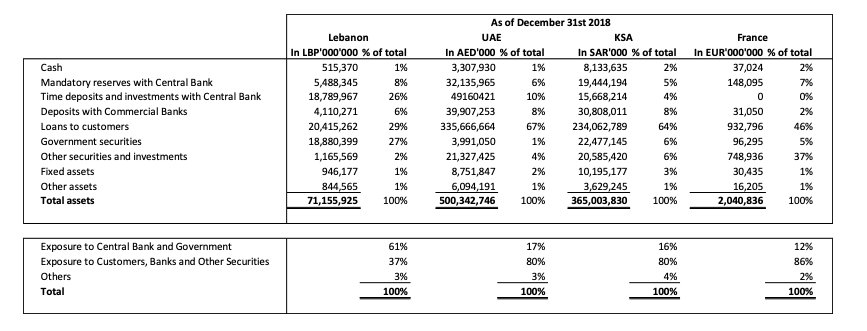

Your deposit forms a resource that banks should invest wisely, while balancing the risks for the better interest of shareholders. How do you think the bank’s board of directors directed the use of your deposits? The easiest way to answer this question is to compare the weight allocation of investments between Lebanese, UAE, Saudi and French Alpha banks. The figures below are actual numbers extracted from published bank financial statements (I chose not to share the bank names):

Source: Financial Statements of Publicly Listed Alpha banks – December 31st 2018

Looking at the financial statements and exposure, it is clear that the allocation of Lebanese banks strayed away from the regional and global standards. While UAE, Saudi and French banks had exposure of an average of 15% to sovereign investments (Government and Central Bank) and 82% towards loans to customers and corporations, investments in banks and other securities, the Lebanese Alpha bank under study invested 61% of its resources in sovereign investments and 37% towards loans to customers and corporations, investments in banks and other securities.

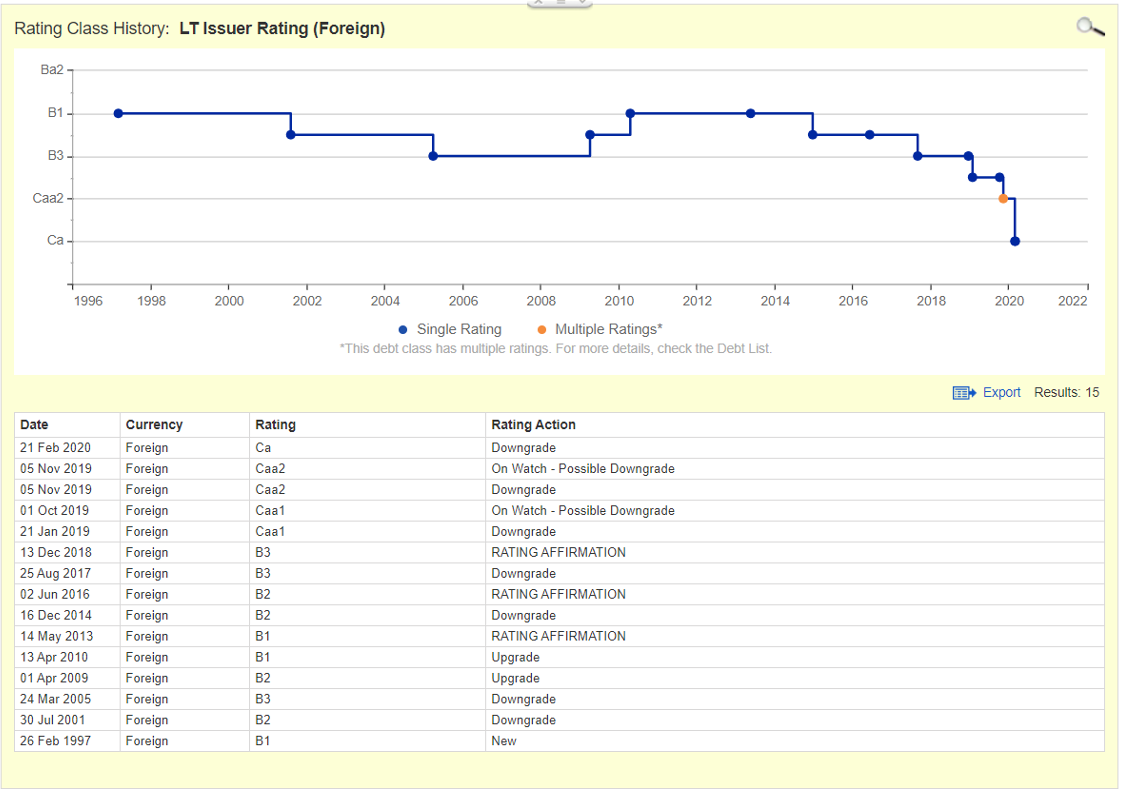

Is there a plausible reason why Lebanese banks concentrated their investments on sovereign securities? Is it possible that at that time (December 31st, 2018) the sovereign risk was low? Surely not. By that date, the credit rating of Lebanese government securities was at Caa1, which is 7 notches below junk classification.

Source: Moodys.com – Credit Rating of Government Securities of Lebanon

Going back to the definition of corporate governance which includes fairness, transparency and accountability, how fair is it to place depositors’ money in such risky positions? How transparent was the board with its shareholders? Will any of them be held accountable? I can easily say they breached their fiduciary duty towards most, if not all, stakeholders.

3. The Government

There is no dispute that Lebanon’s economy is dysfunctional. This can be attributed to a negative current account balance, an expensive currency, and heavy reliance on remittances and transfers from the Lebanese diaspora. In addition, the government budget has run a deficit for as far as I can remember. No area of government spending was spared major leakage in the past three decades or so. Further adding to the problem was that taxes, which are considered a major source of government revenues, were not treated seriously by both taxpayers and tax collectors.

Rather than taking the hard way of adopting major economic reforms and fighting corruption, the easy way out for government officials was to keep the leakage going and cover budget deficits by borrowing more and more from banks who were happy to offer them our deposits on a silver plate.

Conclusion

Let’s go back to the depositors. Admittedly, I am one of the many people who put savings into Lebanese banks. Later, when the crash happened, I sank into the blame game and asked myself if I could have avoided the loss from happening. Who should we blame? Us or them?

Here is the comforting conclusion. Although we should have been a little more skeptical, there is no need to be that harsh on ourselves. There are two parties who are blamed for our losses and these two parties are the ones who should be held responsible. We are NOT ONE OF THEM! These two parties are sitting in a warm spot in their Faqra chalets while dark rain clouds appear on the horizon. They are sitting, waiting, and hoping that the dark clouds will just pass over.

My only hope is that these dark rain clouds will pass over before destroying homes and futures along the way. All we can do is hold on. Lessons have been learned and what doesn’t kill you, makes you stronger.

Related Articles

Conversations with AI: Accounting for Leased Assets by the Lessee

I had a conversation with AI “Claude 3.5” regarding IFRS 16 and the requirement…

Kaali Peeli Epiphany: Unveiling the Currency of Contentment

Lao Tzu once said The one who knows he has enough is rich. This is an…

Financial Reporting Implications of COVID-19: In-Depth Analysis for Service-Based Entities

The COVID-19 outbreak took the world by surprise and triggered a VUCA…

Increasing Your RETURNS-20 Curve While Flattening the COVID-19 Curve

It has only been a few months since the COVID-19 pandemic began. Yet,…