Increasing Your RETURNS-20 Curve While Flattening the COVID-19 Curve

It has only been a few months since the COVID-19 pandemic began. Yet, the negative impact of this crisis has been felt in all aspects of our life. Besides the tragic human physical and mental consequences, this crisis has forced many companies to change their operating models by downsizing (or proper sizing), exposed the competence (or incompetence) of governments, and disrupted stock markets and economies. In the meantime, the vast majority of stock exchanges have taken measures to mitigate the spread of losses as investors were tested as panic positive and have demonstrated severe symptoms of panic-selling.

On a positive note, some scientists have claimed that the coronavirus is not here to stay for long and that the outbreak will eventually come to an end after a period of 3 to 10 months.

However, before the dust eventually settles and the stock market rebounds in a bullish appetite, supported by regained confidence of investors and a vaccine of stimulus packages from governments, now is the time to consider investing in a self-selected small portfolio of equities that can recapture capital gains during the ensuing stock market recovery. For beginner investors who are interested in exploring this opportunity, I will walk you through my rationale for this selection.

1. Companies with the highest stock price loss: Luxury goods and leisure activities

Defensive stocks, also known as non-cyclical stocks, are resistant to economic downturns as company revenues and profits in this sector are less sensitive to slow downs. Think of necessity items like basic FMCG (canned food, toilet paper and detergents), healthcare (doctor visits, hand sanitizers/face masks and anything in between), and utilities (water, electricity and other Maslow’s physiological basic needs). These sectors are less impacted by the detrimental effect of the pandemic. In fact, some of them will thrive on it. Do not include these stocks in your portfolio.

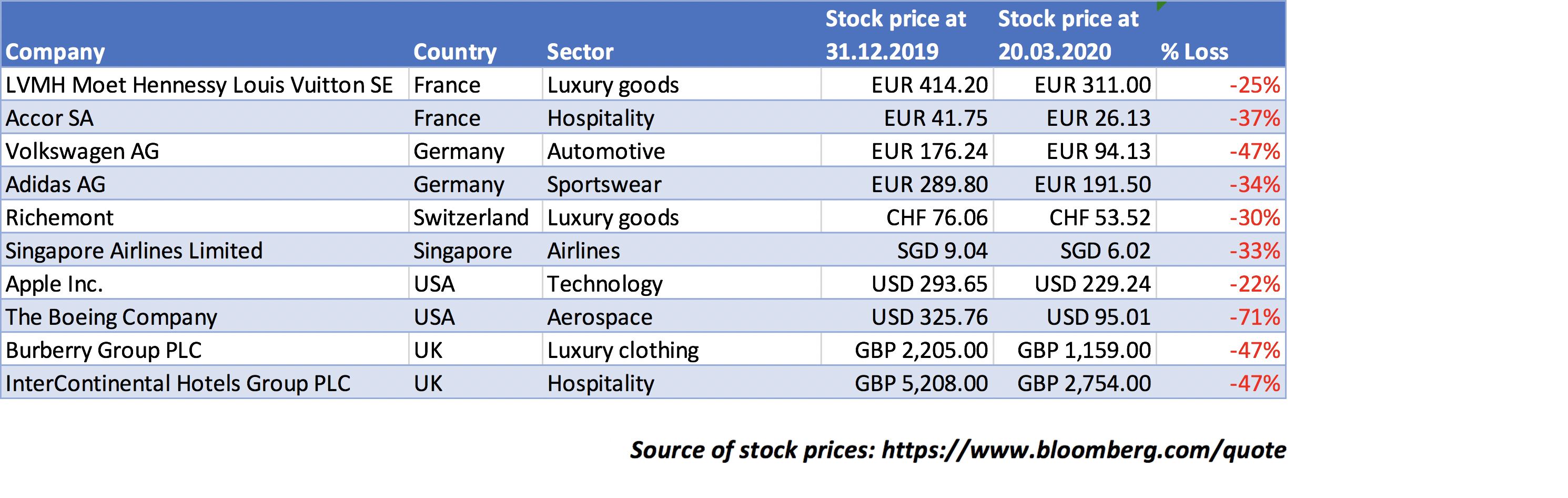

Luxury goods, on the other hand, deeply contrast with necessity goods during crises times. With people today in survival mode, brands that support self-worth and status (iPhone 12, Hermes Birkin bag) and activities of leisure (airplane tickets to Bali, hotel stays at the Ritz) are being replaced by the necessities I mentioned above. Normally, demand for luxury goods and services decreases when the economy slows down and with the outbreak of COVID-19, these sectors have suffered the biggest losses in stock prices. Include luxury good stocks in your portfolio because the large loss they already incurred means a greater capital gain potential.

Exhibit 1: Stock price analysis for selected companies

2. Companies that are too big to fail: Strong brands strongly linked to governments

While I previously recommended including luxury goods and leisure sectors that lost a large percentage of their stock price in your portfolio, you also need to make sure to select companies that are too big to fail. Many analysts are betting that COVID-19 will change our lives forever as many companies that are unable to adapt to the new business realities will not survive. These new realities will include, for example, the removal of artificial barriers to moving more of our lives online as well as the birth and acceptance of digital communities. You need to bet on companies that will exist after this economic mayhem ends. The survivors will be companies with a strong brand, high market capitalization, high spend on research and development, technological agility, and the ability to cope with existential crises. This is the first line of defense.

The second line of defense is a potential government bailout in case of failure (extreme scenario). Except for countries with totalitarian governments or egalitarian societies which might support all kinds and sizes of businesses in such a crisis, countries with democratic governments/elitist societies will witness the survival of the fittest. When push comes to shove and the government decides to bailout financially suffering companies, they will protect the prestigious names that are strongly associated with the government itself (think of Airbus in France, HSBC in the UK, Samsung in South Korea, Aramco in Saudi Arabia, and EMAAR in the UAE). Look for large aerospace manufacturers, airlines, commercial banks, renowned luxury brands, technology, big-box stores, and hospitality (refer to Exhibit 1 for the list of companies that satisfy these criteria).

3. Companies that are fundamentally liquid and solvent

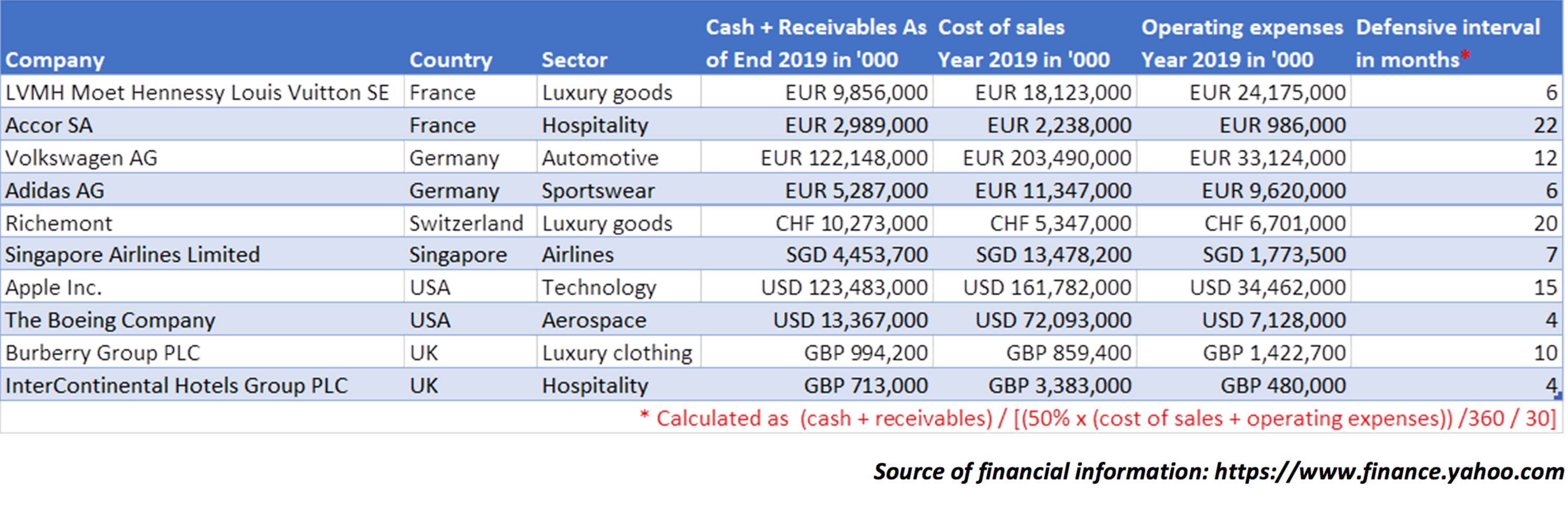

To support the viewpoint on the strength of company brand that was discussed in the second point, we should put some numbers into perspective which can endorse (or not) the financial health of a certain company.

Liquidity is the ability of the company to settle its short-term liabilities by having enough current assets. Solvency, on the other hand, is the ability of the company to meet its long-term commitments. When liquidity is at risk, companies can use their strong solvency position to borrow more funds and cover a short-term deficit. Companies with solid liquidity and solvency are stronger candidates to weather the storm and reach safe shores.

With the current situation, demand for a company’s products or services will be significantly affected. To make matters worse, even if by some chance demand stayed strong, a company’s supply chain and logistics might be disrupted which might hinder the companies’ ability to deliver.

Look for companies with enough cash to survive the next 6 to 10 months. One measure is defensive interval which calculates the cash and receivables available to cover the company cash expenses for the foreseeable future.

Exhibit 2: Snippet for liquidity analysis of selected companies

Looking at the above analysis (ceteris paribus and for simplicity purposes ignoring other financial ratios, market or economic analysis and any potential changes in consumer behavior post COVID-19) we can conclude that companies like Accor SA, Richemont and Apple have higher abilities of defending themselves against financial distress and liquidity challenges as opposed to companies like Boeing and the Intercontinental Hotels Group which have lower abilities.

Conclusion

It is still early in the new world reality of forced home quarantines and many of us are adjusting to a new way living, working, and just surviving. While you are trying your best to flatten the COVID-19 curve, you might as well try to increase your RETURNS-20 curve. This is the time to consider making some shrewd stock investments by considering the basic three steps approach: invest in companies that (1) suffered from big stock price losses, (2) have strong brands that are too big to fail, and (3) are fundamentally liquid.

Note: The analysis reflected in this article represents the ideas of the author and does not represent an investment recommendation nor is it intended for distribution nor exploitation for commercial purposes.

Related Articles

Conversations with AI: Accounting for Leased Assets by the Lessee

I had a conversation with AI “Claude 3.5” regarding IFRS 16 and the requirement…

Kaali Peeli Epiphany: Unveiling the Currency of Contentment

Lao Tzu once said The one who knows he has enough is rich. This is an…

Financial Reporting Implications of COVID-19: In-Depth Analysis for Service-Based Entities

The COVID-19 outbreak took the world by surprise and triggered a VUCA…

Lebanon’s Deposits Crisis: Who’s to Blame? Us or Them?

Let’s travel backward to February 2019. A typical Lebanese citizen, whether…