Supply Chains Are Suffering from “Long COVID”. Here’s Why and What to Expect Next

A beep alerts me to a new message notification—an email from an old friend in Canada. Eleven thousand kilometers separate us, me being in the UAE, yet we are united by the same challenges thanks to the globalization of supply chains. His message reads, “I am revising my investment portfolio and assessing the risk of increasing my tech stocks. But first, I have a question that you might be best poised to answer: are supply chain interruptions expected to last much longer?” It is a question I have become accustomed to receiving almost daily.

Two years after the onset of the COVID-19 pandemic, the world still reels from supply shortages across industries. Shortages are now impacting increasingly complex products—moving away from simple items such as toilet paper and canned tuna in early 2020 to high-tech creations such as microchips, electric vehicle batteries, and industrial machinery today. In this text (Part 1 of 2 on the topic), I attempt to explain the reasons behind the lingering impact of the pandemic on supply chains and why these interruptions, in my opinion, are here to stay for another 3-5 years at best. In Part 2, I follow up with a series of strategies to help companies improve the preparedness and robustness of their supply chains.

Before we delve any deeper, permit me a curveball. Today, we’re witnessing not the result of one COVID-related supply shock but rather two distinct, notable shocks that occurred within the space of 3 short (or long, depending on your perspective) months. In early Q2 of 2020, the first resulted from a near-complete shutdown of the world’s supply chains as the world went into lockdown. The second, a supply shock in disguise, was the equally damaging (to supply chains) rapid recovery of demand in Q3, owing to swift government intervention through stimulus packages and other fiscal tools. Of course, there were several other events since then that have contributed to the current chaos, such as the UK driver shortage (think Brexit), the grounding of the M/V Ever Given in the Suez Canal (March 2021), the India COVID surge (May 2021), the disruption at the world’s 3rd largest container port in Shenzhen (Jun 2021), and another driver shortage in 2021, this time in the US (why bother with an 18-wheeler when I have a stimulus cheque in the mail?). For good measure, we add the fragile state of US-China trade relations and the war in Ukraine into the mix.

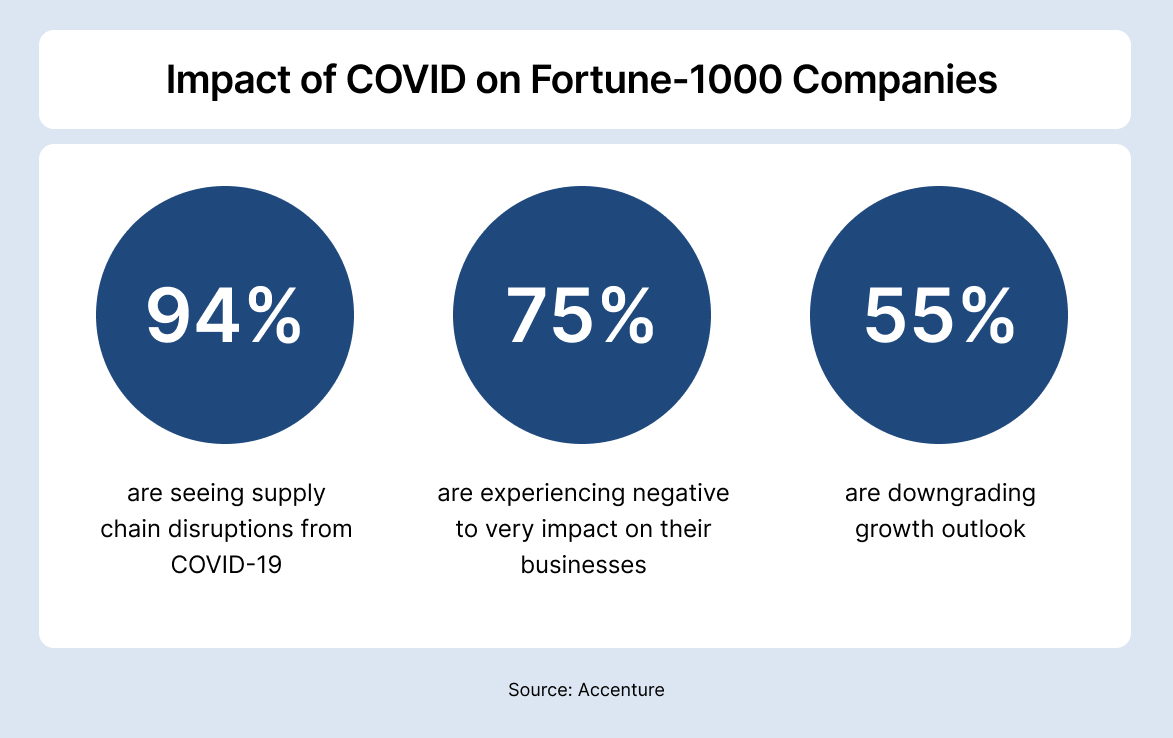

Still, shouldn’t our supply chain problems go away once the disruptive event has passed? After all, it has been two years since the original COVID supply shocks. The answer is No. A recent survey of Fortune-1000 companies conducted by Accenture found that 94% of businesses are still reporting COVID-related supply chain disruptions, 75% of those saying the impact on their companies ranges between negative and very negative. Fifty-five percent have downgraded the growth outlook as a result.

To understand why this is so, let us start by stating a vital premise: a supply interruption describes a situation where supply cannot match demand; yet despite the term “supply interruption,” the root of the problem usually lies on the demand side of the equation. Supply chains need clarity to consistently meet demand—clarity of the long-term variety. Manufacturers need to know what you want, how you want it, and when and where to deliver it well ahead of time so that they can gear not only themselves but also their suppliers, their suppliers' suppliers, and their suppliers' suppliers' suppliers, going all the way back in the chain to those businesses operating earth’s fields, farms, mines, oceans and what have you. (In fact, the author believes that it is suppliers all the way down, and not turtles as suggested by ancient Hindu mythology.)

With that in mind, think about the time you ordered that chicken breast at your favorite restaurant, only to change your mind 10 minutes into the meal preparation process—your appetite was suddenly whetted by an order of ribeye arriving at an adjacent table. You too now desire the ribeye, but that is out of stock, sending the kitchen into a frenzy as the chef tries to deal with the unwanted half-cooked chicken breast and is sent scouring for an urgent, fresh supply of red meat. Supply chain disrupted!

Now let’s scale that hysteria up to the level of a global supply chain for a more complex product, looking at, say, microchips (arguably a driver of tech stock prices today). If you produced smartphones, chances are you experienced growth before the COVID-19 outbreak. When you placed an order for 10 million microchips, your supplier, in turn, likely ordered raw material to produce 11 million microchips. Why 11 million, and not 10 million? Just in case, business was good after all. To keep up with this rising demand, their suppliers, along the same line of thinking, would have added another 10% of their own (they have suppliers, too) for a grand total of 12.1 million’s worth of material. Another three rungs back in the supply chain, and we are now geared for 16 million microchips. The term coined for this phenomenon is the Bullwhip Effect (which I explain here), an allusion to the ever-growing ripples a whiplash creates the further out we go from the point of action.

Curiously, the opposite also holds. In times of negative economic outlook, a reverse bullwhip takes effect, with orders for raw materials decreasing at an increasing rate as we move back to the source of supply. When COVID first struck, the immediate sales outlook was so miserable that many companies canceled orders altogether, breaking the backs of many of their suppliers further back in the chain. When demand came gushing back the following quarter, many of those suppliers were already bankrupt or had long exited their space. (Remember, for an order to make its way 4 to 6 rungs back in the supply chain may require 3 to 9 months.) What we ended up with was a situation akin to a bullwhip being lashed from both ends, with very little science to help forecast how the ripples played out. And supply chains, they just don’t fare well in turbulence. To make things worse, consider that a smartphone has 299 other parts, each requiring its own supply chain, multiplying the problem that many times. For further context, also consider that microchips are used across 169 industries, some as sophisticated as automotive, where a single car can require up to 35,000 parts.

Even when the parts are available, it has become harder to deal with the logistics of delivering them from the supplier to your store and from your store onward to your customer. The interconnected nature of supply chains means that a disruption anywhere will drastically impact the rest of the world, least because we all share the same 17 million shipping containers. COVID-related and other disruptions have resulted in just 5 million of those being in circulation today. Many boxes were sent to off-the-beaten-track destinations early in the pandemic to deliver emergency response goods as facemasks and have been lying around since, as shipping liner vessels chase lucrative trade winds elsewhere. In another instance, the grounding of the M/V Ever Given further illustrated how a logistical bottleneck along the Suez Canal can delay the delivery of made-in-Manchester Coco Pops to a neighborhood store just across the channel in Paris.

Finally, the impact of the pandemic has been such that many companies have changed their business models for good in keeping with changing consumer habits. Those that survived have accelerated their transformation, including through tech investments in e-commerce platforms, last-mile delivery, 3D printing on-demand, automation, and robotics. This has caused further uncertainty as suppliers along the different rungs of the chain try to make sense of our new world and the novel demand patterns it produces.

To my investor friend in Canada, I say we are a long, long way from any sustainable reprieve from supply chain interruptions. Are we powerless in the face of all this? Not completely. In my next article, I address different strategies for making supply chains more robust, commenting on the merits and limitations of each. Until then, hold off on that investment.

Ahmad Ghannoum is a partner at Meirc Training & Consulting. He is the author of Supply Unchained: Trade, Treachery and Transformation Along the Silk Road.

Related Articles

PART 3: Supply Chains are Suffering from Long COVID. This is what they’ll recover to look like

Supply chains, too, have escaped with their lives, having contracted Long…

PART 2: Supply Chains are Suffering from Long COVID. Here’s the Vaccine

Global supply chains are still suffering from Long COVID two years after…

Business in the Time of COVID-19

The cat is out of the bag. One way or another, the novel coronavirus outbreak…

No Cheese, Please! Balancing Flexibility and Efficiency in Supply Chains

Don’t get me wrong, I love Thai food. But having spent the best part of…