Porter’s Diamond Model and the Competitive Advantage of Nations

In 1776, Adam Smith, considered to be the father of economics 1, wrote his seminal book “An Inquiry into the Nature and Causes of the Wealth of Nations”. In his magnus opus, commonly known as “The Wealth of Nations”, Smith described how nations embarked on the process of building wealth by touching upon topics such as the division of labor, productivity, and free markets 2. While this book was written over 240 years ago, many of the concepts that Smith proposed are still relevant in today’s globalized market. In fact, “The Wealth of Nations” is the second most cited book that was published before 1950 in the social sciences area 3.

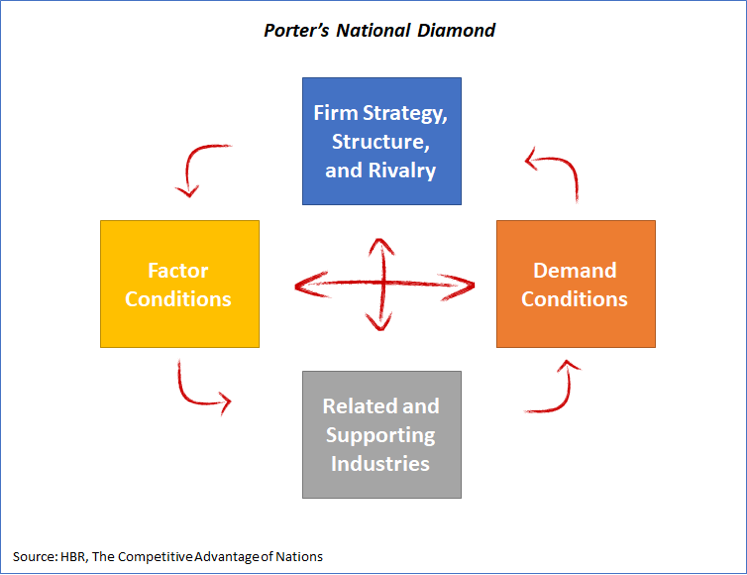

In 1990, Michael Porter, considered to be the founder of the modern strategy field 4, put a modern twist on Smith’s ideas by publishing a book entitled “The Competitive Advantage of Nations” 5. In this book, based on a study of ten nations, Porter argued that the productivity of firms and workers collectively was key to national wealth. While this argument was not new, as Smith had discussed this in the 18th century, Porter went further by detailing how the national and regional environments can support, or impair, that productivity. He created a diamond-shaped framework to explain the international competitiveness of different industries.

Porter’s Diamond framework consists of a system of four mutually reinforcing factors: factor conditions, demand conditions, related/supporting industries, and firm strategy, structure and rivalry 6. If these conditions are favorable, domestic companies will continuously innovate and as a result, they will remain competitive internationally. On the other hand, unfavorable conditions will result in the inability of these companies to compete globally.

In this article, I will expand upon each of these four components and argue that government involvement, and sometimes their non-involvement, is crucial in creating the right environment for companies to flourish.

Component #1: Factor Conditions

This component in the diamond refers to the availability of natural, capital, and human resources. Some countries can be rich in natural resources, such as Saudi Arabia which has ample oil reserves , and Qatar, which is rich in natural gas. Other countries, such as Singapore, are rich in their human resources. Being rich in human resources (or human capital) means that the country has created factor conditions that foster the establishment of a skilled labor force. This usually means that the nation has created excellent infrastructure and a solid scientific knowledge base. These “created” factors are much more important than “naturally” occurring factors as they ensure the country’s competitive advantage over the long term. Venezuela, compared to Singapore, is a good case in point. With a population of 32 million, Venezuela has the largest proven oil reserves in the world 7 while Singapore has barely any natural resources. Yet Singapore, with no natural resources, has a $90,000 GDP per capita compared to $11,000 for Venezuela 8. In the long term, human capital development is what counts. How does Singapore do it? The country is keenly focused on developing, and continuously revising, its human resource strategies in conjunction with other national strategic economic policies 9.

Component #2: Demand Conditions

Local demand has a sizeable effect on how well industries within a certain country do. While a larger market can present more challenges, it also creates opportunities for businesses within that industry to grow and flourish. The constant demand from local customers will push companies to grow, innovate, and improve quality. This can also lead companies to venture beyond their borders and compete internationally. Take the airline industry as an example. Spurred by strong local demand (from both companies and the government), Boeing grew to be one of the leading aerospace manufacturers in the world. Nations can gain a clear competitive advantage in industries where demand from local customers puts pressure on companies to always do better.

Component #3: Related and Supporting Industries

It is difficult for an industry to grow without a supporting ecosystem that can provide technology and spare parts. This support is especially important as the industry grows more complex. The presence of capable suppliers within a nation is key for the development of companies that use those suppliers for cost-effective access to quality inputs. In addition, the sharing of knowledge and information between suppliers and manufacturers gives companies within an industry early access to new products. For example, within the computer industry, Apple benefited widely from the existence of highly capable suppliers who not only manufactured parts, but also supplied Apple with innovative products that spurred growth. The mouse that Apple popularized in its Lisa system in 1983 was, in fact, first invented by Xerox. While Xerox is about to disappear into Japan’s FujiFilm 10, Apple is one of the most valuable companies in the world. Therefore, a supporting ecosystem is critical to any industry’s success, for without it, other companies in other countries will surely steal the show.

Component #4: Firm Strategy, Structure, and Rivalry

While the first 3 components are straight forward, this is the one component that countries get wrong. The competitiveness of firms in any country is largely determined by how those firms set strategy and structure themselves. Governments can impact this with laws that establish corporate governance rules. In addition, firms within an industry will be positively affected by a certain level of competition in that country. This is sometimes counterintuitive to many governments who prefer to protect their companies by limiting competition. This is dangerous, because in the long-term it will lead to an industry’s demise. When companies face no competition, they grow lazy and fail to innovate. And when companies fail to innovate, they die. It’s that simple. That is why governments must focus on ensuring that there is healthy competition between different firms. The US government is a good example as it has enacted antitrust laws (the laws that ensure competition) that exist in an open-market economy and that are meticulously implemented. In 1998, when the US government felt that Microsoft was cornering the operating system and browser markets, they threatened to break the company up.

Porter’s Diamond Model is a framework that explains why industries in some countries are much more developed and competitive compared to industries elsewhere. In our globalized world, remaining competitive in the long term is a must. There are different tools that can help government policy makers analyze possible policies. Porter’s Diamond Model is a powerful framework that can be used both to describe the sources of a nation's competitive advantage and the path to obtaining such an advantage.

1 Sharma, R. (2020). Adam Smith: The Father of Economics. https://www.investopedia.com/updates/adam-smith-economics/

2 O'Rourke, P. J. (2018) On ‘The Wealth of Nations’. New York Times. https://www.nytimes.com/2007/01/07/books/chapters/0107-1st-orou.html

3 Green, E. (2016). What are the most-cited publications in the social sciences (according to Google Scholar)? LSE Impact Blog. London School of Economics.

4 Harvard Business School. Institute for Strategy and Competitiveness. https://www.isc.hbs.edu/about-michael-porter/Pages/default.aspx

5 Porter, M. (1990). The Competitive Advantage of Nations. Harvard Business Review.

6 Grant, R. M. (1991). Porter's ‘Competitive Advantage of Nations’: An assessment. Strategic management journal, 12(7), 535-548.

7 U.S. Energy Information Administration (2020). Annual crude and lease condensate reserves. https://www.eia.gov/international/data/world/petroleum-and-other-liquids/annual-crude-and-lease-condensate-reserves

8 WorldBank (2020). GDP Per Capita (PPP).

9 Osman-Gani, A. M. (2004). Human capital development in Singapore: An analysis of national policy perspectives. Advances in developing human resources, 6(3), 276-287.

10 Los Angeles Times (2018). Xerox, once a business icon, is about to disappear. https://www.latimes.com/business/hiltzik/la-fi-hiltzik-xerox-20180213-story.html

Related Articles

The Comedy of KPIs: Al-Meqyass Family Saga

Once upon a time, in a cozy suburban neighborhood, lived the Al-Meqyass…

Public Sector Benchmarking: Driving Success Through Comparative Analysis and Innovation

When I worked in the public sector, benchmarking was one of the crucial…

Advanced Visualization Tools: Generating Sunburst Charts

Data visualization is a crucial aspect of data analysis, allowing users…

Cobras and the Law of Unintended Consequences

In my government strategy course, I present a public sector policy and…