Reading the Warning Signs

Turbulent economic times are always fraught with risks. So, it makes perfect business sense to develop strategies to manage such turbulences, especially when we consider their increased frequency, intensity, and the urgency to respond and adapt quickly in order to maintain business continuity and sustainability.

Considering the unprecedented and threatening economic and business nature of the risks brought by the COVID-19 pandemic, companies of all sizes are straining to cope with difficult economic realities on the short and long terms, and how to stay relevant and afloat until such time as when the world economy restarts again. Obviously, some companies will be more successful in managing the risks than others, and I am a firm believer that companies are as good as how their leaderships read the warning signs, and more importantly how they behave to address them, and the action plans they put in place to remedy possible fallouts.

In my profession, I cover risk assessment and risk management. I address the topic from the perspective of Enterprise Risk Management or ERM. For those of you who may not be familiar with the term, here is a quick definition I got from the Investopedia.com website:

“Enterprise risk management (ERM) is a plan-based business strategy that aims to identify, assess, and prepare for any dangers, hazards, and other potentials for disaster—both physical and figurative—that may interfere with an organization's operations and objectives.”

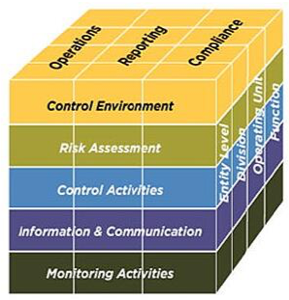

Governments, companies and institutions that plan for ERM as a strategy, approach the topic from a framework perspective, and one of the most popular models available is the one developed by the Committee of Sponsoring Organizations of the Treadway Commission or COSO. The model focuses on evaluating internal controls, which refers to the processes adopted and effected by an organization’s board of directors, management and other relevant personnel in order to provide reasonable assurances of business continuity under all circumstances, particularly under adverse conditions. Such assurances normally address business viability in the following three areas:

- Effectiveness and efficiency of the 'operations'

- Reliability of 'financial reports'

- Compliance' with applicable laws and regulations.

Five key components need to work together to help an internal control system deliver the desired assurances associated with an entity’s mission, strategies and related business objectives. These components are:

- Control environment

- Risk assessment

- Control activities

- Information and communication

- Monitoring

These five components need also to work together to establish the foundation for sound internal controls within the organization through directed leadership, shared values and a culture that emphasizes accountability for control.

A valid question to ask is whether the COSO model could have saved the world from the unthinkable and unprecedented health and economic risks that COVID-19 pushed in our face. Allow me to remind you that the COSO model came into existence as another valiant attempt to create stronger governance, compliance and risk management by publicly traded companies, particularly those in the financial sector. Even though, it is voluntary for companies and institutions to adopt the COSO model, in some countries, governmental institutions like central banks, have made it mandatory for all banks to become COSO compliant.

The COSO model is quite comprehensive, but sadly it is not the model that saves us from risks, it is how we adopt and apply the model that matters. When we apply reliable and well-developed governance and risk models correctly they deliver outstanding results, particularly in turbulent times. When we ignore them, the results could be catastrophic, like what happened with the COVID-19 pandemic.

Let me introduce you to Dr. Li Wenliang. You have probably heard of him, but for those who haven’t, he was one of the first victims of the Coronavirus outbreak. He was also one of the first medical professionals and heroes to succumb in the fight against the virus. You see, Dr. Wenliang was the first one to raise a warning sign against the Coronavirus and give disturbing details around how it quickly spreads, attacks and damages our respiratory system. He raised the red flag way back in late December 2019, informing his fellow doctors and alerting the authorities about the troubling nature of the virus.

How did the existing governance system read and react to Dr. Wenliang’s warning signs? Well, instead of commending and honoring him for his work and for his findings, Dr. Wenliang was silenced and reprimanded for his candor and outspoken approach. Despite the rejections he faced, Dr. Wenliang kept on fighting the virus to the last breath left in his lungs.

This is not the only incident where missing the warning signs led to catastrophic outcomes. Mark Bly, BP’s head of safety and the leader of the investigation into the Deepwater Horizon oil spill, admitted that “… company’s onsite managers could have prevented the catastrophe had they picked up warning signs of a breach of the cement seal at the bottom of the well, as well as unusual pressure test readings, only moments before the explosion.” 1

Risk management is not about creating models that look good in the eyes of the public. It is about adhering to the plans and implementing them with a high sense of accountability, especially when warning signs first arise. It is about how we react to information we receive from our surroundings, about how we decode and analyze data under normal conditions and, specially, in times of crisis. It is about our ability to put in place a proper communication plan and stick to it when unexpected events arise, to ensure information is transmitted in a reliable and trustworthy fashion. Silencing Dr. Wenliang was a catastrophic mistake. I sincerely believe we could’ve reduced the impact of the virus by folds if we had taken his warning more seriously.

It is too late now, and my comments are coming after the fact. But imagine how things could’ve turned out if global government officials and the World Health Organization had worked closely with Dr. Wenliang and engaged in a transparent effort to assess the virus. Imagine how the situation could’ve been different had everyone taken the necessary local and international precautionary measures to put a halt to the spread of the virus? I think you would agree that things could’ve turned out quite differently.

Instead, efforts were spent dismissing vital information, sweeping facts under the rug and painting a rosier picture than what was really happening, or shifting blame to divert attention. This is what happened in 2015 when Volkswagen’s leadership misread the warning signs that their persistent denial of the company’s wrongdoing, in relation to “defeat devices” that can cheat emissions tests, could result in a PR and ecological scandal of colossal negative proportions. Also, In 2019, Facebook’s management failed to read the warning signs resulting from their shady track record of compliance lapses about their users’ personal privacy, especially in light of the Cambridge Analytica scandal and the major political crisis that ensued.

So, what can we learn from all this? How do we make sure to pay more attention to the warning signs when they arise? In the past two decades we have seen our fair share of economic crises, and with each one our response has been to develop or improve existing business models, policies, procedures, or enact more rules and regulations to stop us from doing the same mistakes again. So, what are we doing wrong?

Whenever we introduce a risk model into the workplace, the intention is to establish the foundation for proper accountability based on transparency and integrity. With time this accountability weakens and falls victim to personal interests, conflicts and power struggles. Eventually, accountability becomes only a façade prone to missing warning signs, leading to serious operational problems and credibility issues with costs that could exceed one’s imagination, like what we are experiencing with the COVID-19 crisis.

Discipline is important when it comes to following rules and regulations. In addition, accountability permits us to adhere and uphold rules and regulations in a responsible fashion, backed by integrity and courage. More importantly, in times of crisis, discipline and accountability should permit us to confront self-serving interests that undermine those serving the common good and help us endorse sensible business rules and regulations instead of narrow-minded red tape.

Lastly, I bow my head to Dr. Li Wenliang and to every doctor, nurse and first responder who are sacrificing their lives to save us and our humanity from this terrible and dreadful virus.

1 Based on the article “Gulf oil disaster: BP admits missing warning signs hours before blast” by Suzanne Goldenberg, US environment correspondent. Published in The Guardian on Sep 8, 2010.

Related Articles

The Comedy of KPIs: Al-Meqyass Family Saga

Once upon a time, in a cozy suburban neighborhood, lived the Al-Meqyass…

Public Sector Benchmarking: Driving Success Through Comparative Analysis and Innovation

When I worked in the public sector, benchmarking was one of the crucial…

Advanced Visualization Tools: Generating Sunburst Charts

Data visualization is a crucial aspect of data analysis, allowing users…

Cobras and the Law of Unintended Consequences

In my government strategy course, I present a public sector policy and…