Turning the Credit and Collections Department into a Profit Earning Function

Below is a real-life case study by Jon Ray MICM.

A few years ago, I was doing some consultancy work for one of the big European banks. This institution had some issues with poor collection performance and internal relationship problems; most especially between Customer Service staff and the Collectors. The Customer Service Department and the Collections Department were not only in the same building but were next to each other, separated only by a semi opaque glass screen.

The problem definition:

Customer Services were the favoured department since they were seen to treat the customer well and were responsive to their requests. Most of their work was repetitive; the customers enquired about balances on accounts, transaction issues etc: sometimes Customer Service staff would try to sell customers insurance products.

The Collections Department were less well regarded in the organisation and not at all well regarded by Customer Services. Collectors were seen as the people who ‘said nasty things to customers’, ‘upset people’ and were aggressive on the telephone when they spoke to debtors.

Customer Services were in the habit of passing calls to Collections when the calls got ‘out of hand’, even though the call had nothing to do with collections. Customer Service also patched the calls through to Collections when they wanted someone to shout at the customers! Externally customers complain about bad treatment from Collectors and so the Collectors often feels under siege.

Senior Management often regard Collections as a cost to the company, rather than a profit – this is old fashioned thinking: so too is that Collections and Credit Control are back-office functions, hidden from company and customer view. I’ve always believed that Collections has unnecessarily bad press. This is not helped by management who tend to measure collection performance by what is left to do rather than what has been done well. Negativity goes a long way towards demotivating staff.

The fact is in challenging economies, and competitive markets, every internal department in an organisation needs to turn a profit. Collections and Credit Control is by no exception. The Credit Department is the department that interacts with more people in your organisation than any other – think about the interactions daily. It is the Credit Department that creates business. Restricting credit to business for example kills economies – 96% of trade is dependent on extended terms of payment. Credit is the lubrication for the economy and yet the credit the department is not itself well regarded. To maintain good levels of borrowing in an unstable economy requires due diligence however too tight a hold on borrowing has a negative effect. It is important to have a robust collections effort to stabilize cashflow and manage flow rates.

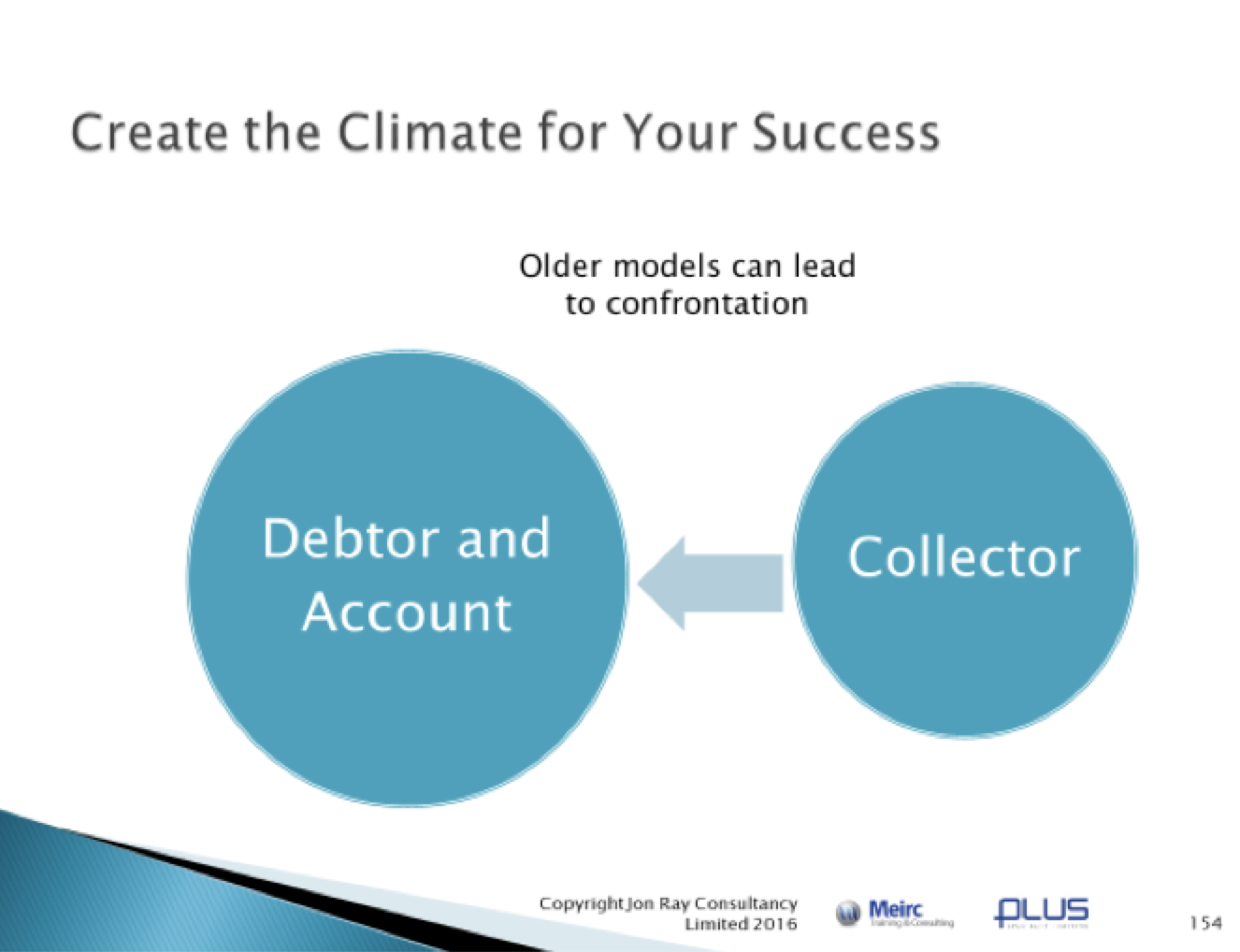

If the organisational climate is not conducive to co-operative working between departments than the culture of the whole organisation is affected adversely: partly the problem with my client. I this situation the relationship with customers is influenced and a negativity pervades all that is done. Old fashioned Collectors believed that the way to get a bill paid was to bully and bludgeon the debtor into submission by using aggressive techniques that left the customer with nowhere to go. The relationship looked like this:

Here we see the Collector lumping together the Debtor and the overdue account; the collector is distanced from the customer and the customer is left to form their own strategy for repayment.

My client had this approach. Collectors and Managers were untrained: both were under pressure to perform.

The situation had been ongoing for some time; it affected both the business and the morale of the staff. Externally an ‘us and them’ situation between customers and organisation had developed, whilst internally, relations between Customer Services and Collections was at an all-time low.

The economy was in nose dive a business decision was taken to expand the Collections department as more customer got into debt and could not pay.

Rather than recruit and select from outside of the business, after discussion, it was decided to enlarge the role of the customer service staff to take collection calls - as well as customer service calls. Until then I had never seen a riot in an office building but when the news broke it was probably as close as I’ve got!

The fact is, a very important point was being missed and it was this:

Debtors are customers and customers are vulnerable in times of financial crises – they need more support it times of difficulty than when their accounts in order.

What was needed:

This was about Training Managers and Collectors: it was about changing cultures within the organisation and unifying goals, whilst improving collection levels.

Primarily it was about training. People fear what they do not know and put simply Customer Services were unware of how Collections operated. They were unaware of the relationship that needs to be established between bank and customer to reach an agreement on payment.

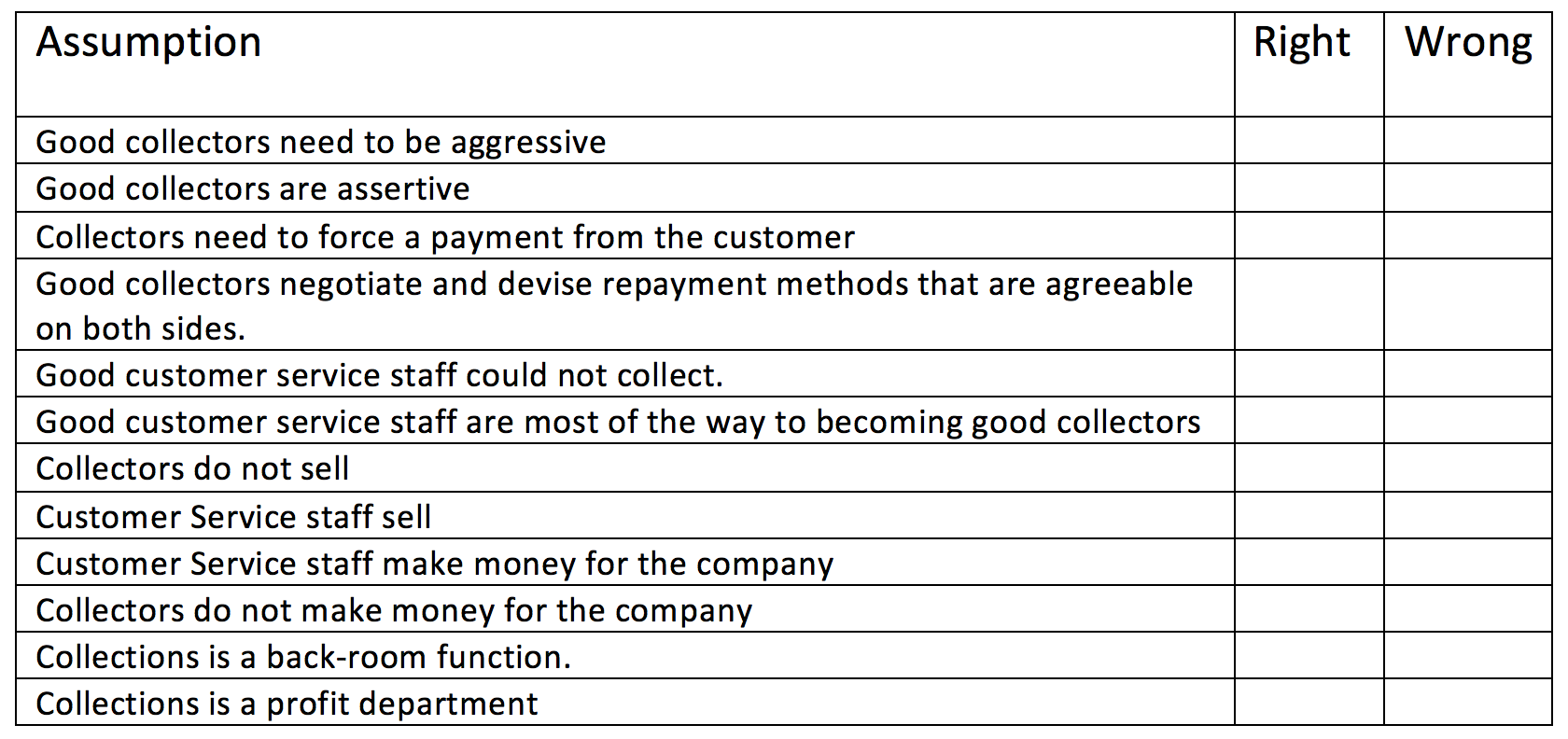

Exercise

As Credit Mangers Check your assumption rating – cover up the two columns on the right side of the table. Read the statements and decide whether you feel they are correct or incorrect assumptions – reveal the answers at the end – no cheating!!

You may have been surprised by some of the above. Most people are surprised at the statement that collectors sell. You may ask how? Well, they ‘sell’ a reason to pay. We buy things that will give us benefit in our lives. It is the job of the collector to sell the benefit of paying. Sceptical? Go and look at the soft skills requirements of a sales person and compare them with the requirements in a Collector person specification – can you see the differences? There are very few.

Some of the above needs better explanation than space and time will allow here. I expand on these during the Meirc Plus programme.

In my client example the Customer Service staff became collectors.

They didn’t think they would.

They didn’t think they could.

TThey didn’t even want to.

They did however embrace their fears and open themselves up to new prospects and challenges: these are the people you need on your team.

Bringing about change is never easy however the rewards can be startling. All this needs to be managed and managed well.

There are many definitions of training; the one I like is:

“training influences behaviour”

Simple changes of behaviour, brought about by training, enable better relationships between client and organisation; management and staff. A different conversation takes place and different result are achieved.

Of course, the business climate must be right for this to happen, a management function – something I cover in the programme and management are entirely responsible for this.

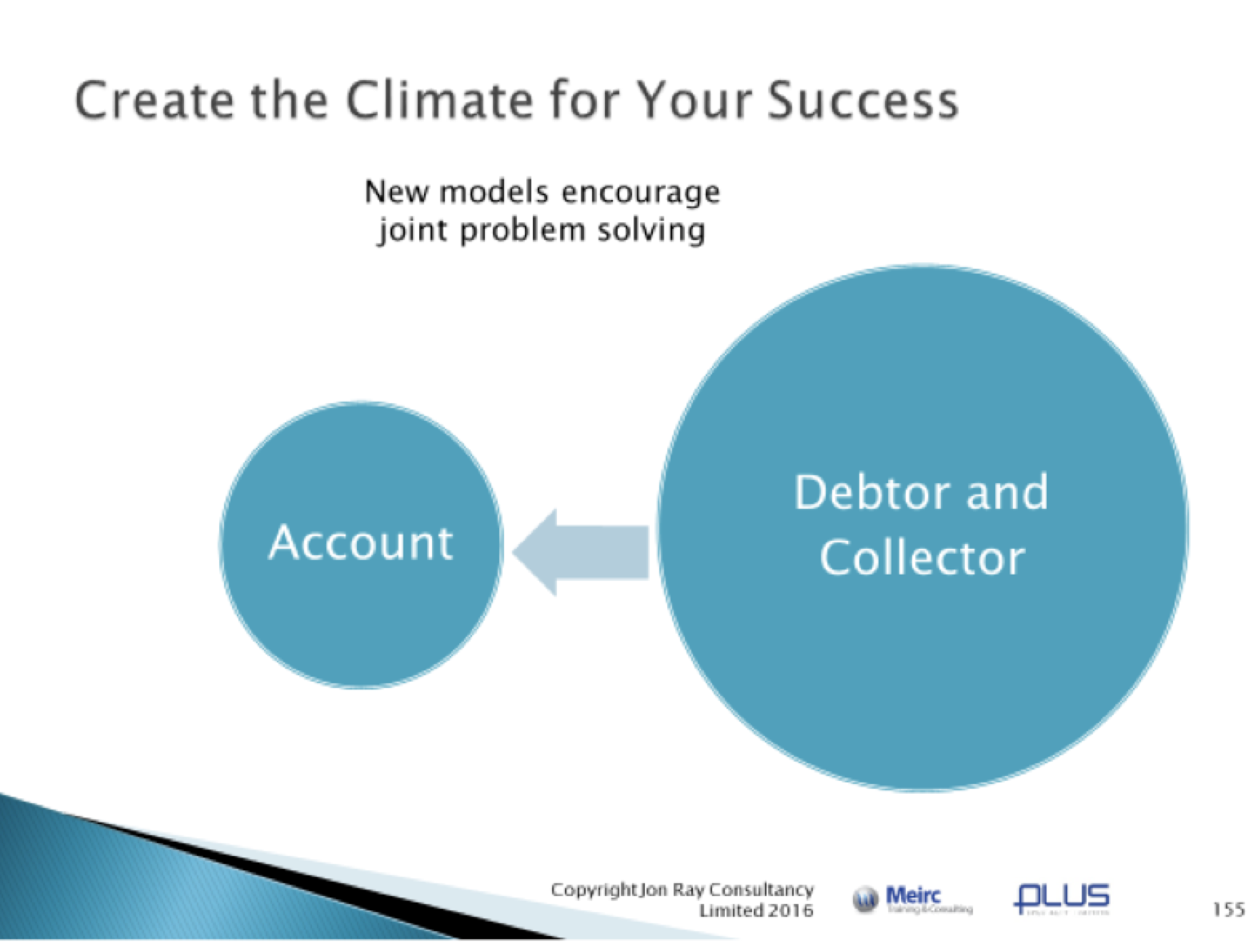

Bringing about change encourages more productive relationships and delivers better results: the business climate changes and often costs decrease. Relationships between customers and organisation improve via the interaction of the customer with the frontline staff and managers of the credit function are in the driving seat to bring all of this about. New models reflecting better relations between Collector and Debtor look like this:

Here we see that the Collector and the Debtor are ‘on the same side’ looking at the account; developing this type of relationship is important both are looking for a realistic strategy to settle a payment: focussed on the same goal – this can be done through training. The Collector now seeing the debt from the customer point of view. The customer looking at the debt objectively but now with the Collector who can offer a creative solution. The debt is separated from the debtor creating an atmosphere of joint problem-solving

This is a very different climate from the old fashioned aggressive approach of the former slide.

Bringing about a different climate, through better management and training will transform collection results.

I delivered training to both staff and management; this was great since I made the training relate across each group, integrating it to ensure a consistent message. The managers got an overview of the Collector’s training and the Collectors got to see some of the management training. This avoided each of the parties questioning what was going on and improved communication and understanding of common gaols. It also meant that the was a common language and an understanding of each other’s roles in the process.

The result:

The outcome was very good. The staff were now multi skilled and they could take both customer service and collection calls without moving desks. They combined the empathy associated with customer service with the assertiveness required in collections.

Management changed the environment to reflect a better working space. There was more internal promotion of the department and its success. Management structure change and new roles were created. Management introduced incentives schemes – that worked. A more positive approach to reporting results was established.

Management introduced a Collector School, to train new Collection skills and an internal Academy recognising achievement. The Department gained a better internal reputation and was considered a profit centre that became more understood by the rest of the organisation.

Collector job satisfaction levels improved, members of the former Customer Service Department had greater involvement in their customer’s situations.

Organisationally staff turnover went down. This is no small point since staff recruitment is a hugely expensive cost to any organisation. If you can manage to stabilise the workforce, by developing the skills of your staff, you have stabilised your costs; forecasting becomes easier as overheads are more predictable.

The culture shift:

My Customer Service guys in Europe had a lot of fun on the training. They saw collections in a new light. Management and Supervisor training were integrated so there was a sharing of knowledge and both staff and management maintained better relations and developed more innovative and effective ways of managing.

New challenges were embraced: Customer Service staff felt greater job satisfaction since the collection calls had more challenge and greater texture. This demystification of collections raised the profile of the Collections Department and Collectors got to understand the skill set of the Customer Service guys.

It never ceases to amaze me the magical effect of training on organisational profile or profit.

Conclusion:

Change is never easy but consider this: would we really go back to our old telephones now we have smartphones? No? Why? It’s because the change brought about by innovation has shifted our perception of what is good

Credit is not the poor relation of the customer service effort – it has great importance. A customer has poor service from a customer service agent and maybe the organisation will receive a letter of complaint. A customer has a bad experience from a collections call and organisation does not receive a payment.

Collections and credit make commerce work, they fuel the economy. 96% of commercial sales rely on credit in some form. Restricting credit can be to the detriment of not just the individual or organisation but the whole country.

Training is a key issue but so too is management attitude toward the Credit and Collections function. Something so important must have a raised profile, be regarded as essential by the business, recognised as a key player in organisational development and brought to the centre of the business. Good management of this function can be brought about by innovative modern management development.

About the Author:

Jon Newsom-Ray MCICM

Jon Newsom-Ray MCICM facilitates PLUS Specialty Training’s Managing the Collections Team course.

He has worked in the banking and credit industry for more than 30 years and has delivered numerous training programs and consulting engagements around the world.

Jon is an experienced international trainer and consultant, having worked in more than 25 countries and trained hundreds of managers and credit professionals through his Masterclasses. Jon is a major exponent of best practice and continuous improvement in the credit industry having worked with the Financial Services Skills Council (FSSC) and the Chartered Institute of Credit Management (CICM), successfully formulating qualifications and standards for the industry.

Having been one of the originators of Profitability from the Credit Function, Jon was a keynote speaker at the World Congress for Collections and Credit Control in Mexico City. He has developed, written and designed the well-received flagship credit control/collections program ‘Advanced Collections’.

Related Blogs

Why Finance Certifications Matter: An Experienced Perspective

In the realm of finance, I frequently field questions about the tangible value of professional certifications. Is there a discernible edge in holding a CFA, CMA, FP&A, ACCA, or CFE designation? Given the subst...

Bitcoin: Is it a Ponzi Scheme?

Every country has probably had at some point in time its own Charles Ponzi, an influential con artist who lured investors to entrust him with their money and who paid quick returns to the first investors from money inv...

Building an All-Star Credit and Collections Team

Training opportunities, in less enlightened organizations, are handed around like chocolates in a box. In some instances, they are often chosen with only as much consideration. This approach is mostly the...

The Audit Report Writing Mindset

Perhaps the most challenging part of an auditor’s role is the communicating of results in order to achieve effective remediation of any control deficiencies. Audit reports are, perhaps, the ...