Tax Structuring Lessons from Apple Inc.

Tax on Profits by U.S Corporations in Foreign Countries

Under the current U.S tax regulations, American companies are required to pay a 35% tax rate on profits generated by their foreign branches and subsidiaries. However, the law has a big caveat or a (intentional?) loophole: companies can indefinitely defer the taxes on those profits — as long as the profits stay overseas. To prevent those profits from being taxed in the US, entities may opt for the “Check-the-box” rule which allows the taxpayer to treat their foreign subsidiaries like foreign corporations which, for all intents and purposes, are inexistent in the eyes of U.S law [1]. Still, once the company decides to repatriate its profits to the US, it has to pay a tax of 35% over and above whatever it has already paid in taxes to the foreign jurisdiction. Such rules and grey areas provide room for companies with multinational reach to dance around tax legislations, apply creative structuring techniques and reduce their tax burden. Are these tools ethical? Can Gulf based companies learn and apply anything from what their US counterparts are doing? These are the questions I will try to answer in the rest of this article.

Dividends Distribution versus Stock Repurchase: Which One Reduces the Tax Bill?

Like many U.S entities such as Google, Facebook, Pfizer and General Electric, Apple Inc. is avoiding taxes on profits generated in places like Bermuda, Grand Cayman, Ireland and Luxembourg. By the end of the 2017 fiscal year Apple had accumulated in those jurisdictions piles of cash and marketable securities amounting to USD270 billion [2]. Keeping these profits abroad however is not a permanent or sustainable solution. Apple needs funding to spend on their research and development in Cupertino, California, particularly given that three years have passed since the introduction of their last flagship product, the Apple Watch in 2015 (following the iPad in 2010, iPhone in 2007 and iPod in 2001) and that markets are expecting some kind of an outstanding, market redefining product release soon. Rationally, Apple could defer distributing dividends under the premises of reinvestment in the business, however this would not be entertained for long by thirsty investors.

Tax structuring plays a role in Apple’s decision on how much to repatriate and by which mechanism. If Apple decided to transfer those funds to the US and distribute them in the form of cash dividends, double taxation would probably apply: first on Apple paying a 35% tax on profits and second, once those dividends are paid in cash, each shareholder will have to declare dividend income on their individual tax return and another tax will be paid (certain deductions will be permissible). Hence the total tax bill on the pocket of the shareholder will be higher than 35%.

Alternatively, Apple can avoid this sour route and exercise a shares repurchase plan, thereby distributing profits to its shareholders without exposing them to the double taxation. The share repurchase plan would subject the shareholders’ gains to another type of tax, which is tax on capital gains due to stock value appreciation. The IRS taxes long-term capital gains (gains on investments held for more than 1 year) at a substantially lower rate of between 15% and 20% [3] to encourage individuals and businesses to keep their investments. Having looked at the options above, one can see it is more profitable for Apple’s shareholders to receive the return on their investment in the form of share price appreciation rather than cash dividends, which explains the annual shares repurchases of around USD300 million by Apple in the last couple of years.

Borrowing to Pay Dividends: Impact on Cost of Capital

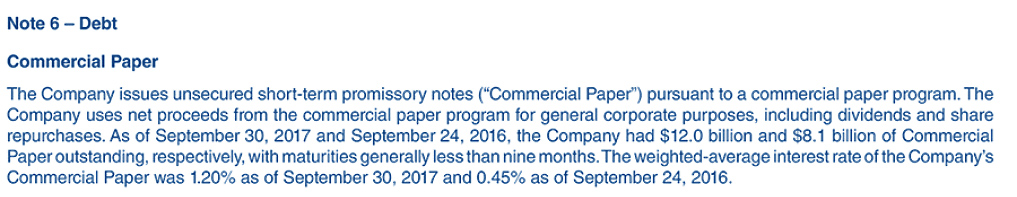

Now that Apple needs to repurchase shares, it needs the liquidity to complete the transaction. Apple decided to issue bonds with floating and fixed interest rates at a weighted-average interest rate of 0.45% - 1.2% in 2016 and 2017 year-end.

Exhibit 1: Extract from Apple Inc.’s 10-K Report

Adding more debt to Apple’s balance sheet helps it lower its weighted average cost of capital and optimizes its capital structure in several ways:

- Apple has an A+ corporate credit rating: this is just below the highest triple-A rating [4] which allows it to issue debt at low yields and secure liquidity for its debt issued.

- Interest on debt is tax deductible: with the high corporate income tax rates in the U.S, having high weights of debt in the capital structure allows an organization to benefit from tax savings on interest expense.

- Required return on equity for the software and technology industry is above 20%: adding debt to the capital structure to replace equity would reduce the weighted average cost of capital and therefore increases the company value.

Ethical Tax Avoidance or Unethical Tax Evasion?

10 years ago I worked as a senior tax consultant at PriceWaterhouseCoopers. Part of the job was to understand the client’s operations and business model, and recommend a group structure that would result in the lowest taxes for the group while still abiding by international tax laws. Our recommendations included creating companies and funds in tax havens such as BVI and Cayman Island, establishing holding companies in countries with favorable tax rates for holding legal entities, performing sales through offshore companies and even closing some subsidiaries. For our Middle East clients, a common recommendation was to open a purchasing and production hub in United Arab Emirates. The UAE entities would buy the raw materials, produce and sell at very high margins to the regional subsidiaries thereby locking the profits in the UAE which had a zero corporate income tax. Regional entities bought from the UAE entity at a high price and generated a smaller profit that was taxed at rates ranging between 15% and 20% in their respective home countries.

The fact of the matter is that any country’s tax law can have a grey area that can be exploited by taxpayers. With the evolution of cross-border trade and with companies expanding their divisions to operate on a multinational level, the lack of global tax laws increases the ambiguity of treatment from a tax perspective. In my opinion, as long as an organization is benefiting from those loopholes to reduce their tax burden, it still falls in the category of ethical tax saving. It remains for the tax inspectors to assess whether a violation exists.

The Future Outlook

With President Trump at the helm, talks are being held to provide tax breaks for U.S companies that repatriate profits earned in foreign countries back into the U.S. A precedent occurred in 2004, when Congress passed the American Jobs Creation Act, which provided a one-time tax break for companies that wanted to repatriate their offshore profits. Companies brought home $312 billion at a tax rate of just 5.25 percent [5]. If this does not happen this time around, we can expect the U.S to impose taxes on profits generated and kept abroad to prevent companies from keeping piles of cash out of the reach of the U.S treasury. In the meantime, I believe Apple should be doing a preventive second round of tax structuring to avoid the upcoming tax bill.

Lessons for the Gulf region

Currently, tax regulations in the Gulf Cooperative Council countries are still lenient, and corporate income tax is still limited. Companies with foreign ownership are subject to a tax linked to the extent of the foreign ownership. Other taxes are applicable on local owners such as Zakat at the rate of 2.5% in KSA and in support of scientific progress at a rate of 1% in Kuwait. For most GCC companies, profits achieved by their international divisions are still exempt from local taxes, however it looks like the tax scene in the GCC region is changing. Value-added-tax and excise tax have been applied at introductory rates, and rumors has it that new taxes will be implemented in the foreseeable future. Corporate income tax, tax on dividends, tax on international profits earned by subsidiaries and more should be anticipated.

Companies operating in the GCC might soon be required to look at their operations from a global perspective and consider which legal structures and business model would be the most profitable. Apple’s example shows only one angle of tax structuring that can be applied by companies, but it serves as an indicator of techniques needed to plan for future tax exposure. The years will pass and the question will always be one: how can companies increase shareholder value? Tax savings is undeniably one of the answers.

References

- [1] https://www.forbes.com/sites/leesheppard/2013/05/28/how-does-apple-avoid-taxes/2/#2253b3355fba

- [2] http://investor.apple.com/secfiling.cfm?filingID=320193-17-70&CIK=320193#A10-K20179302017_HTM_SCE31BDFF50DA58B8962157DE8467840C

- [3] https://www.investopedia.com/articles/personal-finance/101515/comparing-longterm-vs-shortterm-capital-gain-tax-rates.asp

- [4] https://www.marketwatch.com/story/apples-aa-rating-affirmed-at-sp-global-matching-googles-alphabet-and-the-us-2017-06-13

- [5] https://www.nytimes.com/2017/11/29/business/taxes-offshore-repatria

Related Articles

Kaali Peeli Epiphany: Unveiling the Currency of Contentment

Lao Tzu once said The one who knows he has enough is rich. This is an…

Financial Reporting Implications of COVID-19: In-Depth Analysis for Asset-Based Entities

The COVID-19 outbreak has brought most industries to their knees. Vitor…

Financial Reporting Implications of COVID-19: In-Depth Analysis for Service-Based Entities

The COVID-19 outbreak took the world by surprise and triggered a VUCA…

Increasing Your RETURNS-20 Curve While Flattening the COVID-19 Curve

It has only been a few months since the COVID-19 pandemic began. Yet,…