Let Us Discuss Shoes!

I was explaining the concept of “Assets” during one of the “finance for non-finance” training programs I regularly facilitate. In said program, I highlight the difference between assets and expenses by explaining how assets are meant to benefit more than one economic / accounting period, i.e. more than one year, whereas expenses are consumed only in one accounting period – i.e. one year.

To make it easy for participants, I use examples from real life.

In one of these examples, I said: “Assets benefit the company in future periods by generating revenues and/or cash.” I supplemented that statement with the following example: “In your personal life, if you buy a house it becomes an investment that will benefit you for future periods. This makes it an asset.”

“On the other hand, expenses are consumed in only one economic period. For example, if you spend money on shoes, the costs you incur for these items are considered expenses.”

No sooner had I finished my statement when one of the participants replied: “My shoes are an investment!”

Of course she was correct! This was not the first time I had heard such an exclamation from a program participant. Shoes are investments for a lot of participants out there who spend a considerable amount of time to find them, and a more considerable amount of money to buy them. On top of that, many pairs of shoes could be worn for more than one year and still look awesome!

Yes, pretty shoes are an investment for some people who are quite right in thinking about them this way. Although, I am one of the guilty parties when it comes to overspending on shoes, I was not ready to agree with classifying shoes as assets and treat them equally like houses as per International Financial Reporting Standards (IFRS)!

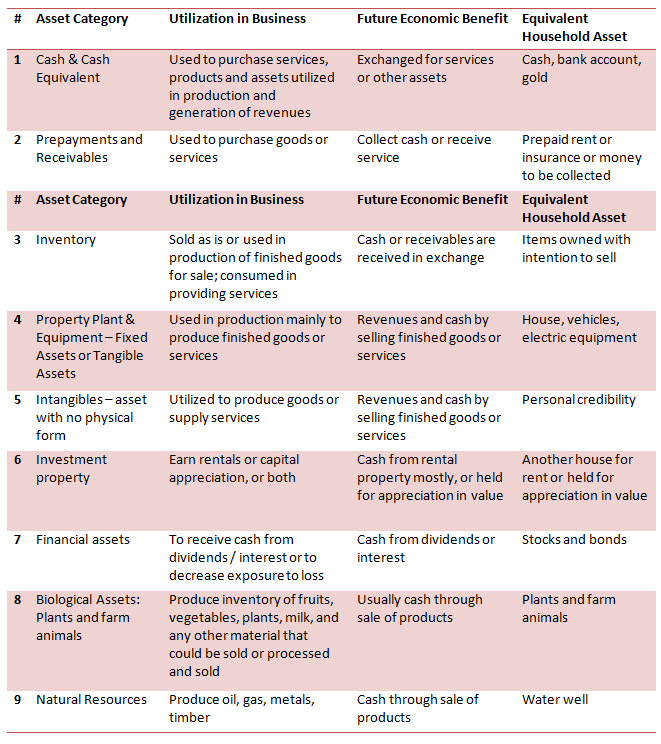

As per IFRS, assets are classified into several categories depending on their nature, intended use and economic benefits. The table below shows how assets are classified and what a household might own that is equivalent to them.

By examining this table, you will notice that a house will classify as an asset in three situations:

- A house bought with the intention to sell will be classified as inventory.

- A house bought to use for sheltering you and your family is classified as property in Property, Plant, and Equipment section, or what people mostly call a fixed asset.

- A house bought to rent out qualifies as an investment property intended to be held for rental income.

Since the house has a physical form, it will neither classify as an intangible asset nor as a financial asset. It will also never be biological, unless you live in a tree house! Nor will it ever be cash equivalent, unless it is made of gold! The above analysis means that for most people the house they buy and use to shelter them and their families will be classified as property. It benefits future periods and could be sold in the end to generate cash.

Back to shoes!

- The shoes you buy with the intention to sell will be classified as inventory according to IFRS.

- The shoes you own and manage to lend to others while charging them a fee are classified as investment. (This could happen regardless of how far-fetched this argument is, due to the fact that you will find an auditor who will agree with your classification!)

- The third weird argument to classify your shoes as assets will be if you are a celebrity and your shoes are sold after you wear them for more than you bought them! In this case you can classify them as investment property.

- Now if your shoes are made of gold, you’ve struck the jackpot! At this point you can classify them as assets under cash and cash equivalents category with no doubt. At that point in time you can afford to hire a very creative accountant and a shrewd lawyer to defend your case in front of any accounting professor!

- Mind you that a new trend is coming out to make shoes from plants. However, they do not generate future revenues or cash to be classified as biological assets. Unless “a highly creative and highly paid accountant” can convince “a highly creative and highly paid auditor” that after you use your shoes you feed them to your other biological assets (animals), which will help in turn generate future revenues and cash, your precious shoes will be assets categorized as inventory!

I don’t think we need to argue that shoes cannot be classified as Property, Plant and Equipment, or intangible assets or financial assets.

This brings us to one scenario applicable to most of us. We do not trade with shoes, rent them out or sell them at higher value after we wear them. We also do not have shoes made of gold. Most of us buy shoes to wear them and throw them away, or donate them after a while.

After all “IFRS” related arguments presented, still this is one of those tricky win-win situations. For artistic and emotional purposes “shoes are investments” providing stylish looks and a beautiful feeling! However, for financial accounting and reporting purposes, shoes are and will always be expenses!

Related Articles

A Workplace Counseling Tale

In the heart of Dubai, nestled amidst towering skyscrapers and the hum…

Building a Culture of Continuous Learning

During times of turmoil and when it comes to reduced corporate spending,…

People Analytics: Transforming Organizations Through Power of Data

Data is crucial in shaping business strategies and decision-making processes…

The Impact of AI on the Corporate Training Industry

Having been at the forefront of corporate training for two decades, I…